Choosing the right life insurance policy can feel like a daunting task. With so many life insurance options available, it’s easy to feel overwhelmed. Two of the most popular types of life insurance are Term Life Insurance and Indexed Universal Life Insurance (IUL). Each has its unique features, benefits, and downsides, which makes understanding the difference crucial to making an informed decision.

This comprehensive life insurance comparison will break down everything you need to know about Indexed Universal Life Insurance and Term Life Insurance, so you can confidently choose the option that aligns with your financial goals and needs.

Understanding Term Life Insurance

Term Life Insurance is perhaps the simplest form of life insurance available. It provides coverage for a specific period, or “term,” typically ranging from 10 to 30 years. If the policyholder dies within the term, the insurance company pays a death benefit to the beneficiaries. However, if the policyholder outlives the term, the coverage expires, and no payout is made.

Key Features of Term Life Insurance:

- Temporary Coverage: As the name suggests, Term Life Insurance offers coverage for a predetermined period, such as 10, 20, or 30 years. After that, the policy expires unless renewed.

- Affordability: Term policies are generally much more affordable than permanent options like Indexed Universal Life Insurance. The lower premiums make it an attractive option for younger individuals or families looking for protection without high monthly costs.

- No Cash Value: Unlike Indexed Universal Life Insurance, Term Life Insurance does not accumulate any cash value over time. You are essentially paying for the death benefit and nothing else.

- Convertibility: Some policies are convertible, meaning you can convert a Term Life Insurance policy into a permanent policy, such as an IUL, without undergoing a medical exam. This feature can be valuable if your financial needs change over time.

When Is Term Life Insurance the Right Option?

If you’re primarily looking for affordable life insurance options and only need coverage for a specific time, Term Life Insurance could be the best fit. Term policies are often used for:

- Temporary Financial Responsibilities: If you have a mortgage, car loans, or other short-term debt, Term Life Insurance can cover those financial obligations during the loan term.

- Young Families: If you’re just starting a family and want to ensure your loved ones are financially protected while the children are growing, a Term Life Insurance policy offers affordable protection.

- Business Owners: Many entrepreneurs use Term Life Insurance to secure business loans, ensuring the business can continue if something happens to them during the loan period.

Downsides of Term Life Insurance:

- No Cash Value: Once the term is up, you don’t receive any return on your premiums.

- Premiums Increase with Age: If you renew your policy after the term ends, the premiums will likely be much higher due to your age.

- Coverage Expires: After the term, you’re no longer covered, meaning you’re left without protection unless you renew or convert the policy.

Understanding Indexed Universal Life Insurance (IUL)

Indexed Universal Life Insurance (IUL) is a type of permanent life insurance that offers both a death benefit and a cash value component that grows over time. The growth of the cash value is tied to the performance of a market index, like the S&P 500, offering the potential for higher returns than a traditional whole life policy.

Key Features of Indexed Universal Life Insurance:

- Permanent Coverage: Unlike Term Life Insurance, IUL provides lifetime coverage as long as you keep up with your premium payments.

- Cash Value Accumulation: One of the key attractions of Indexed Universal Life Insurance is its cash value feature. The cash value is tied to the performance of a stock market index, but you aren’t directly investing in the market. This means your policy can grow over time, offering a financial asset you can tap into later.

- Flexible Premiums: IUL offers flexibility in how much you pay for premiums. If your cash value grows, you can use it to pay your premiums, reducing the amount you need to contribute.

- Tax Advantages: Any growth in the cash value is tax-deferred, and you can take out loans against your cash value tax-free, making it an attractive option for tax-efficient financial planning.

When Is Indexed Universal Life Insurance the Right Option?

If you’re looking for life insurance options that go beyond just providing a death benefit, Indexed Universal Life Insurance could be a better fit for you. IUL policies are often used for:

- Wealth Building: The cash value component of an IUL allows for potential wealth accumulation over time, which can be accessed later in life for retirement, education funding, or other financial goals.

- Tax Planning: IUL offers significant tax advantages, including tax-deferred growth and the ability to access the cash value without triggering a taxable event. This is ideal for individuals in high tax brackets or those who want to create a tax-efficient legacy.

- Long-Term Financial Planning: If you’re thinking ahead and want life insurance to be part of a comprehensive financial strategy, an IUL gives you flexibility and growth potential not found in Term Life Insurance.

Downsides of Indexed Universal Life Insurance:

- Higher Premiums: The added benefits of Indexed Universal Life Insurance come with higher premiums compared to Term Life Insurance.

- Complexity: IULs are more complex than term policies, and understanding how the cash value grows and how fees are applied can be confusing.

- Cap on Earnings: While the cash value is tied to a market index, most IUL policies have a cap on earnings, meaning there’s a limit to how much your investment can grow in a given period.

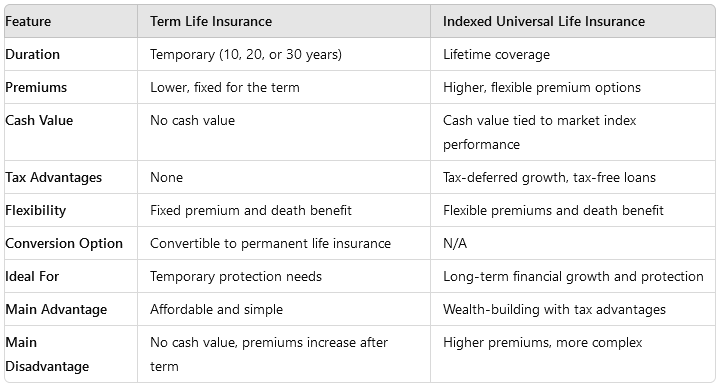

Indexed Universal Life Insurance vs. Term Life Insurance: Key Differences

To make the best decision, it’s important to compare the two side by side. Here’s a life insurance comparison highlighting the most significant differences between Indexed Universal Life Insurance and Term Life Insurance:

Which Option is Right for You?

Choosing between Indexed Universal Life Insurance and Term Life Insurance depends on your individual needs, financial goals, and where you are in life.

Term Life Insurance is ideal if:

- You want affordable coverage for a set period.

- You have short-term financial obligations, like paying off a mortgage or other debts.

- You’re not interested in using life insurance as an investment vehicle or a way to build wealth.

Indexed Universal Life Insurance is ideal if:

- You’re looking for lifetime coverage with the potential to build wealth over time.

- You want to take advantage of the tax-deferred growth and tax-free loans that IUL offers.

- You’re interested in integrating your life insurance into a long-term financial strategy that includes retirement planning and tax efficiency.

Final Thoughts

Deciding between Indexed Universal Life Insurance and Term Life Insurance is not a one-size-fits-all decision. It’s about evaluating your current financial situation, future goals, and how you want your life insurance policy to work for you.

For some, Term Life Insurance is the best choice—offering affordable, straightforward protection for a specific period. For others, Indexed Universal Life Insurance offers a wealth-building tool that provides long-term security and financial flexibility. The key is to understand what you need today and how your needs might evolve over time.

If you’re still unsure which option is right for you, it’s always a good idea to consult with a financial professional who can help guide you through the decision-making process.

Ready to explore your life insurance options? Contact us today for a personalized strategy session to see which type of policy fits your financial goals.